What Does My Insurance Cover?

Insurance is confusing! But we want to help you get the most out of your benefits, so below you’ll find an explainer on how insurance works, whether we’re in-network with your insurer or not.

We participate with a select group of insurers. Why don’t we take all insurances? The answer is complicated. Some insurers simply put too many barriers between us and providing the care you deserve, often by subjecting us and your care to external review by practitioners who just don’t understand that pelvic floor physical therapy is not like PT for a sprained ankle or other acute injury. We don’t expect a condition that may be years in the making to resolve in a handful of visits, but insurances too often do.

Other insurers simply don’t value the one-on-one patient care you receive at Oceanside and their reimbursement rates reflect that. Their networks prioritize care received at large practices where therapists may see more than one patient per hour, and we won’t compromise our care to meet that model.

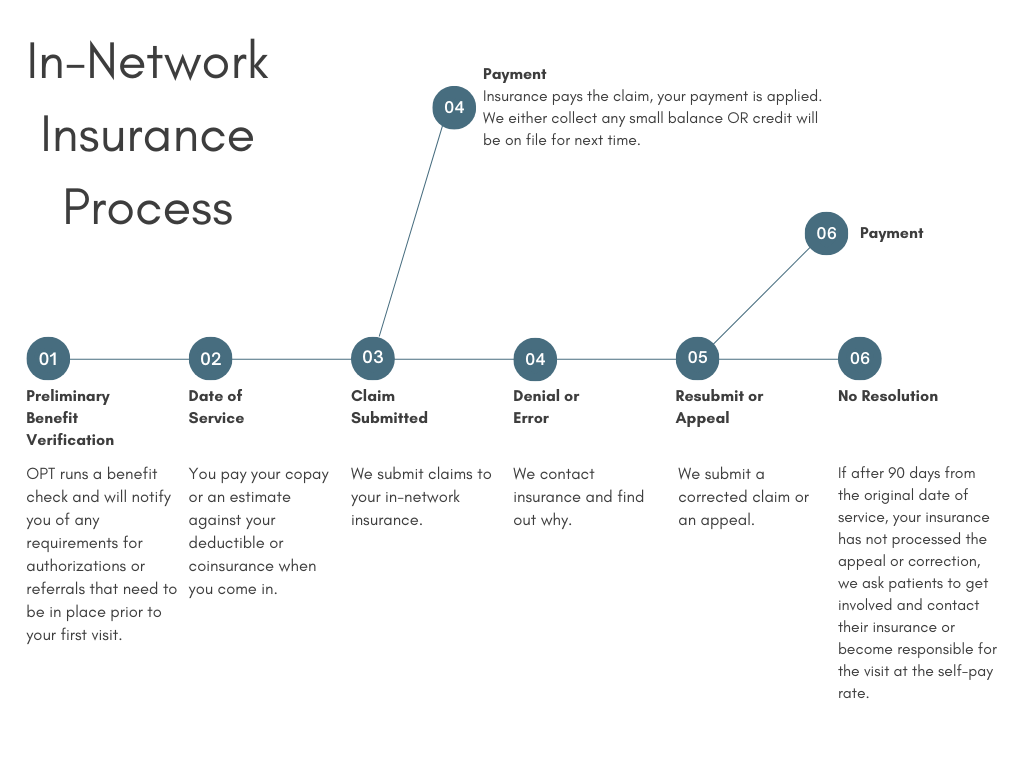

In-Network Insurance Steps

When you schedule your first appointment, we’ll do a preliminary benefits check to verify things like your deductible, coinsurance, or copays and if there are any referral or authorization requirements on your plan. If we need anything from you or your physician, we will let you know. These checks are only preliminary and rely on the data available in provider sites, which is not always accurate or up to date. We always advise patients to check directly with member services about benefits for physical therapy.

When you come in, we’ll collect your copay or an estimate of your deductible or coinsurance. Typically we underestimate deductible and coinsurance, so you can expect a small balance once your claims have cleared insurance. If we overestimate, we’ll either credit the balance to a future appointment or refund your card.

Your therapist will write their notes and assign procedure codes to the visit. Then it gets sent out from our office to your insurance.

If all goes well, the claim is paid! If there is any balance, we’ll let you know.

If something goes wrong and the claim is denied or there is a processing error, we will do our best to find out why and get it corrected or submit an appeal. If we need any information from you, like getting a referral from your doctor, we will let you know.

If after 90 days from the original date of service, we haven’t had any luck getting the claim corrected and paid, we will reach out to you to get involved. Insurance companies are often a lot more responsive to making things right with their members than with their contracted providers! We will give you as much detail as we can about what questions to ask or information to provide when you talk to member services. If the claim is still denied or you choose not to contact your insurer, you will be responsible for the visit at the Out of Network rates. But we always hope it doesn’t come to that.

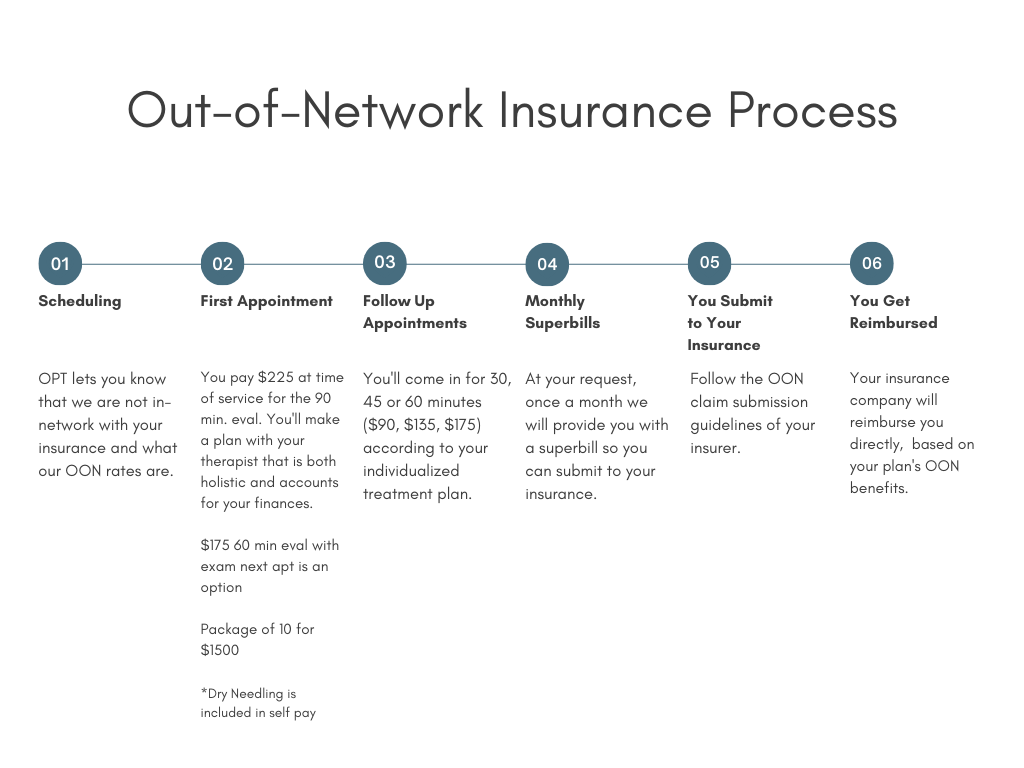

Out Of Network Insurance Steps

When you schedule your first appointment, we’ll let you know verbally that we’re not in-network with your insurance and share our rates. You’ll also receive a standardized “Good Faith Estimate” by email. This estimate does not reflect your actual, individual plan of care, only a typical course of visits. Your actual plan may be more or fewer than what is on the estimate.

When you come in for your visits, you’ll pay a flat fee based on the length of your appointment. $225 for 90 minutes, $175 for 60, $135 for 45, or $90 for 30 minutes. We also offer sets of ten 60-minute visits for $1500.

At your request, we’ll provide you with a monthly superbill so that you can submit claims to your insurance and get reimbursed based on the out of network benefits you may have available. If your insurance has any particular requirements in order for you to submit, like modifier codes or payment information, we will do our best within our system to make sure that you have what you need to get reimbursed.

When you submit to your insurance, you will get reimbursed directly by your plan. No payment will come to Oceanside.

Still Have Questions?

Contact us and we’ll be happy to help!